Want to maximize your Return On Investment (ROI) for your multifamily property? It is essential to analyze various aspects of the property to maximize your ROI for your multifamily property. Time plays a crucial role in real estate investments, and leveraging analytics can significantly impact your success.

One valuable tool for analyzing your multifamily property is DealCheck. DealCheck is a property analysis platform that simplifies the process of accessing a property’s value and offers a comprehensive range of features that enable you to evaluate the financial viability of potential investments. By utilizing DealCheck, you can efficiently assess the profitability and feasibility of your multifamily properties.

Several steps should be taken into consideration to analyze your multifamily deals effectively. This review will guide you through these steps, providing insights into different facets of analysis. By following these guidelines, you can assess your property quickly and effectively, allowing you to make informed decisions regarding its management and optimization.

Table of Contents

Gathering Essential Data for Multifamily Property Analysis

Gathering essential data is the first step toward making informed decisions when analyzing multifamily deals. By utilizing various sources and tools, such as DealCheck.com features, you can conduct thorough market research for short-term rentals.

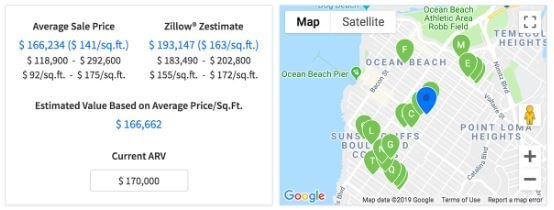

One of the key components in analyzing rental properties is comparing rental comps, which involves researching similar listings to understand their pricing, occupancy rates, and overall performance. By studying these rental comps, you can gain valuable insights into market trends and adjust your pricing strategy accordingly.

In addition to rental comps, recent sales data is crucial in property analysis. By examining the sale prices of similar properties in the vicinity, you can gauge the potential return on investment for your multifamily deals. This information allows you to make informed decisions about property acquisition and estimate future profitability.

To streamline this process and enhance your analysis capabilities further, utilizing platforms like DealCheck can be immensely beneficial. These tools offer a range of features specifically designed for real estate investors and multifamily hosts. From comprehensive financial analysis to property valuation estimations, they provide valuable insights that aid in making well-informed decisions.

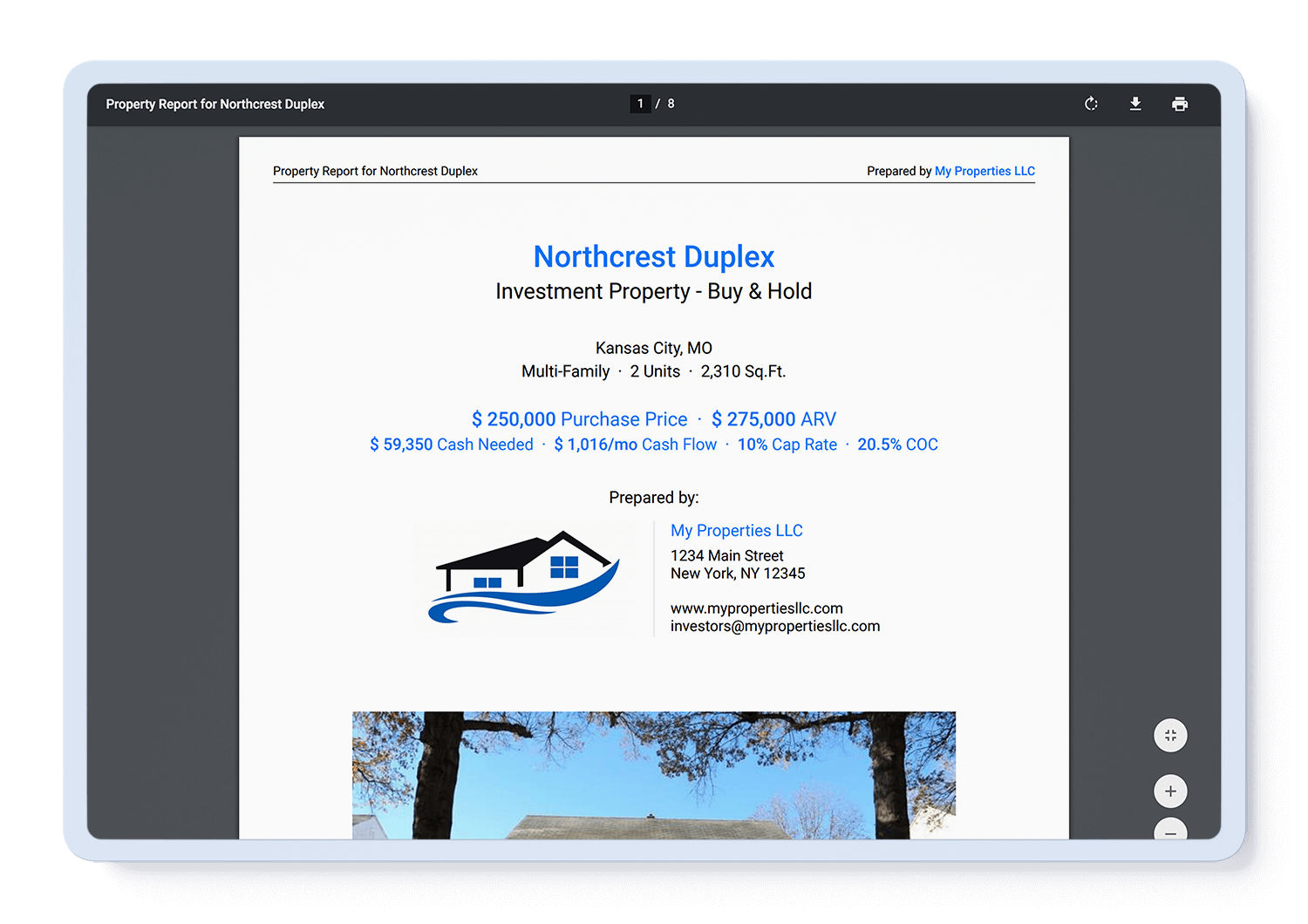

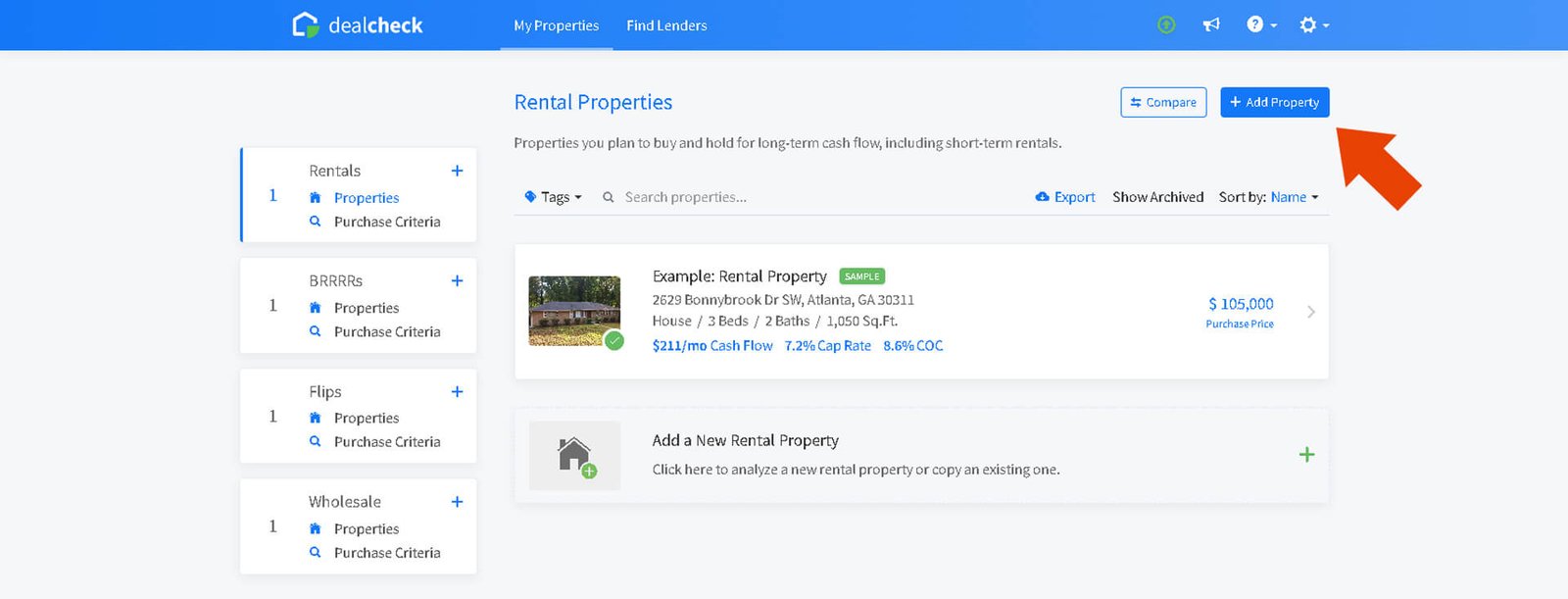

Step 1: Add Multifamily Property to Analyze

Once you create your free DealCheck account, please navigate the rentals list and click Add Property under My Properties.

Conducting a Detailed Financial Analysis with DealCheck

When conducting a detailed financial analysis for multifamily properties, DealCheck is an invaluable tool. Its robust features and user-friendly interface simplify the process and provide accurate insights for investors.

One of the critical aspects of financial analysis is projecting cash flow for multifamily properties. DealCheck lets users input rental income, expenses, and occupancy rates to generate comprehensive cash flow projections. This feature enables investors to make informed decisions based on realistic revenue expectations.

In addition to cash flow projections, DealCheck also facilitates ROI calculations. By considering both upfront costs and ongoing expenses, investors can accurately assess the profitability of their multifamily investment, which helps determine whether a property aligns with their financial goals and investment strategy. You must manually enter the property information to access all this valuable information. However, we created a template specifically for the multifamily home we will assess, which will be covered in the next few steps.

Step 2: Enter Multifamily Property Information

The DealCheck software enables you to import property data, enter it manually, or copy property data from existing properties to analyze them. This guide will walk you through how to enter data for a multifamily property to maximize your ROI. To begin, select Enter Data under ADD A NEW PROPERTY

Step 3: Fill in the Multifamily Property Details

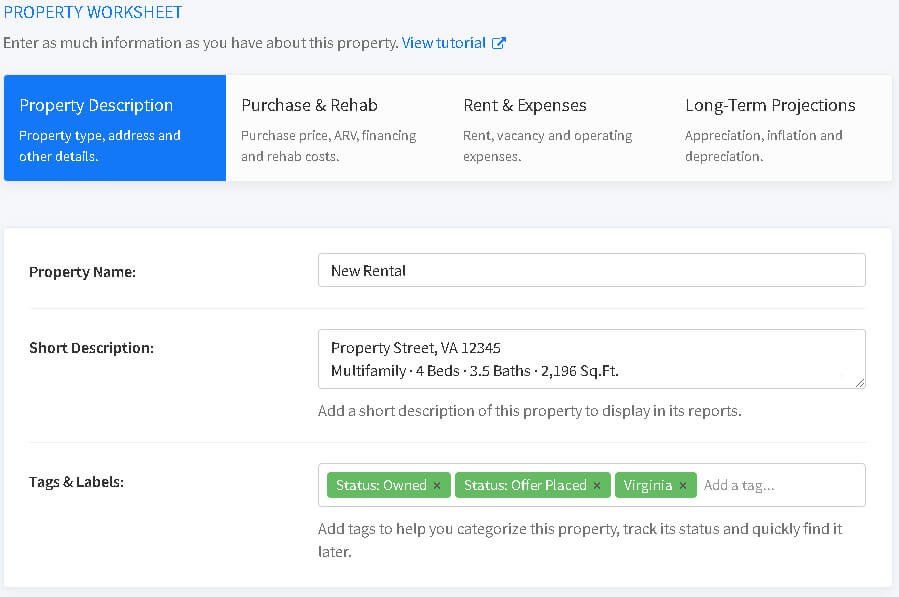

Enter all the applicable information for the multifamily property. In the example below, the Property Name is “New Rental,” the Short Description includes property details that will be displayed in the report, and the Tags & Labels enter information that can be easily associated with the property to make tracking easy and effective. For this walkthrough, we will use the data depicted below.

Step 4: Fill In Pricing Information for the Multifamily Property

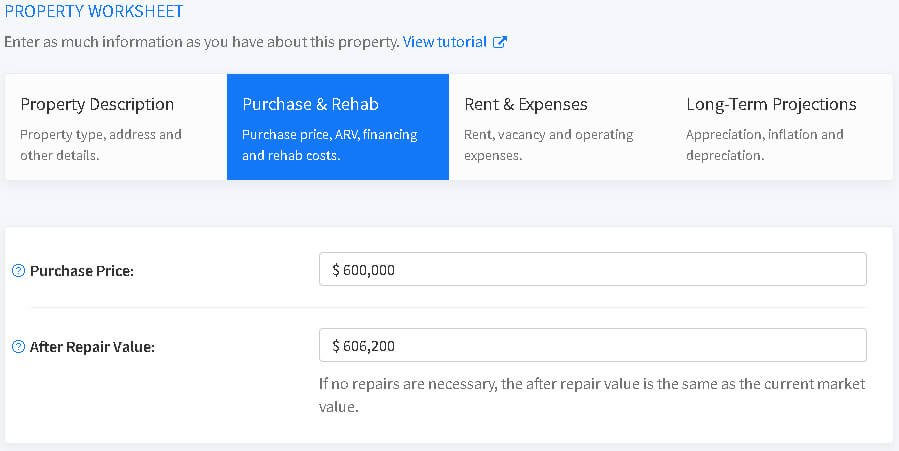

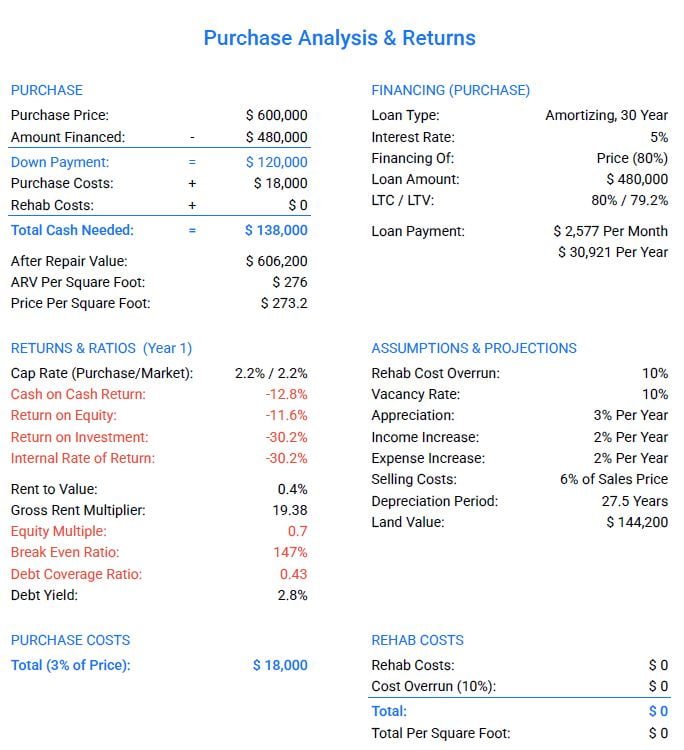

Enter the Purchase Price and After Repair Value Purchase & Rehab section. There is an option for financing if you use borrowed money to purchase the home and purchase cost, which includes closing costs and other associated fees when buying a home. Still, for this walkthrough, we will assume the home is already paid for and ready to be leased. The home was purchased for $600,000 and will include ARV or after-repair value for maintenance and additional work planned to increase value.

Step 5: Calculate Rent and Expenses for the Multifamily Property

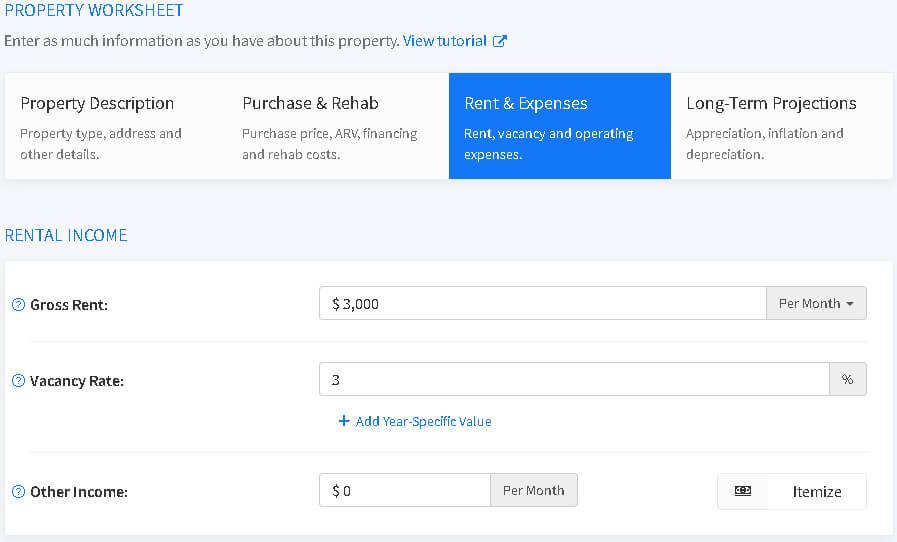

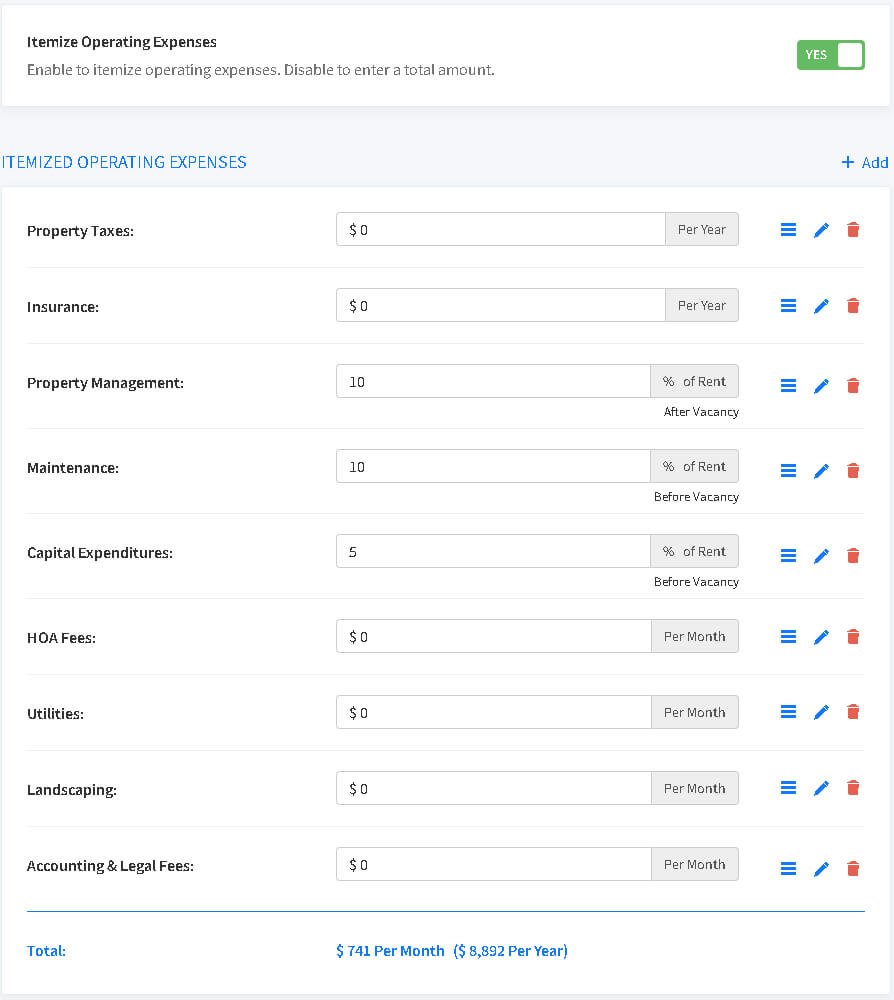

It is vital to estimate the amount of rent and expenses you expect to collect from prospective tenants. Consider any expenses, including HOA fees, lawn care, utilities, etc., when totaling rent. The ITEMIZED OPERATING EXPENSES help you factor in all this information with ease. Also, you want to factor in the percentage of time you expect the rental to remain vacant. This could be due to market conditions, scheduled repairs or rehab, and other factors that can come into play. For this walkthrough, a Gross Rent value of $3,000 is entered with a Vacancy Rate of 3% for the allotted repair time.

Step 6: Fine Tune Long Term Projections for the Multifamily Property

For the final step, you want to enter factors that could impact your overall projections, including income increase, expense increase, and inflation. The DealCheck software allows you to customize these values and factor depreciation for the property with ease. The value is in % per year, giving you a ballpark of where you would stand annually in the ever-evolving real estate market.

Analyzing Rental Comps and Market Trends

DealCheck maximizes the potential of your multifamily property, and it is crucial to analyze rental comps and stay updated with market trends. By doing so, you can gain valuable insights into rental rates, occupancy rates, and market demand in your area.

One of the key factors in analyzing rental comps for multifamily properties is understanding the average daily rates (ADR) and occupancy rates of similar listings in your neighborhood. This information lets you set competitive pricing for your property, ensuring you attract guests while maximizing revenue.

Additionally, assessing market demand is essential to identify peak seasons or events that may drive higher occupancy rates and ADRs. By staying informed about local events, festivals, or conferences that draw visitors to your area, you can strategically adjust your pricing and availability to capitalize on these opportunities.

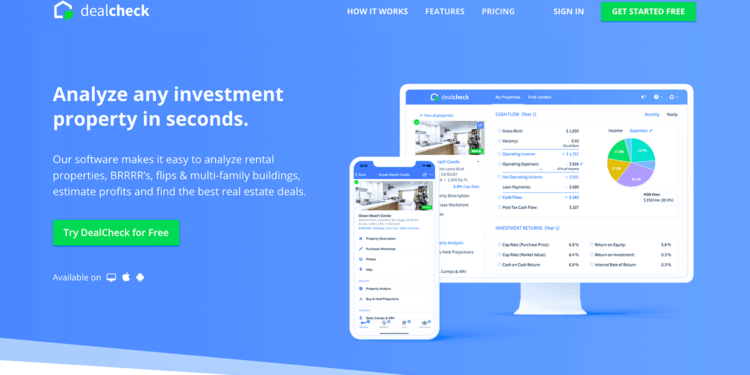

Based on the report below, we can get an overview of the expected return if this multifamily property is converted into a rental property. The report shows we would be in the red with the values entered, so it would not be a viable option for a rental property.

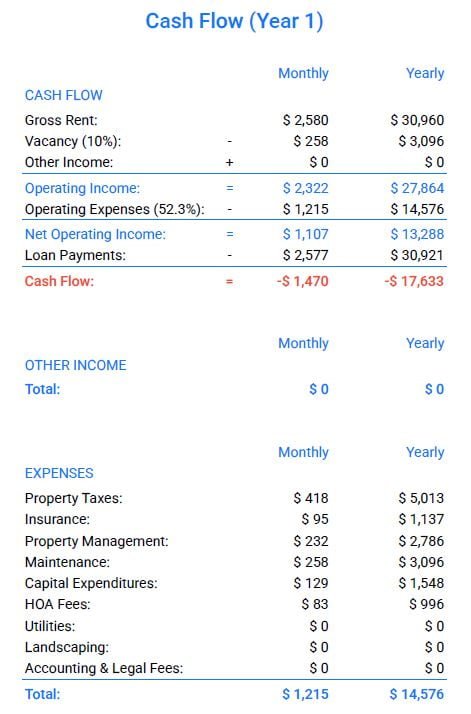

The Cash Flow (Year 1) section of the report breaks down the overall income we expect to make for the year and factors values such as the gross rent, vacancy percentage, and operating expense we entered earlier in the walkthrough. In this example, we would be in the red if we decided to rent this property in the current climate.

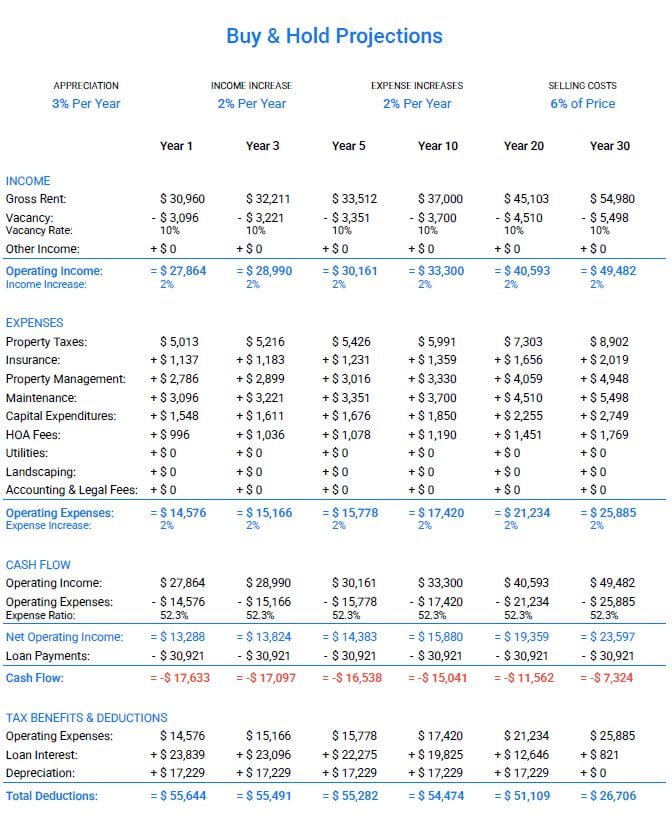

Buy and Hold Projections is a very nifty section of the report because it gives you a holistic overview of your cash flow up to a 30-year milestone. That way, you can make a conscious decision with solid data. We will only cover the three sections discussed in this walkthrough because we have enough information to make an informed decision. Still, you should have an idea of the capability this powerful software has to offer. Once you add your new property, it will remain under your account and can be shared via email or social media platforms like Facebook and X.

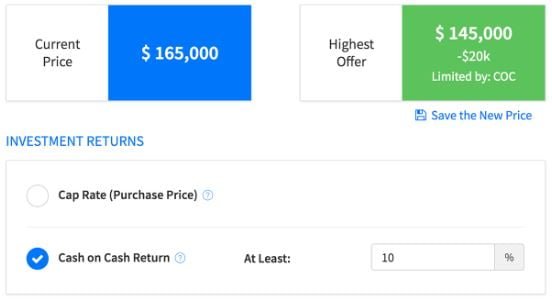

Calculating Maximum Offers for MultiFamily and Condo Rentals on DealCheck

Calculating maximum offers for multifamily properties and condo rentals in real estate investing is crucial. This step plays a significant role in determining the purchase price based on projected income and expenses. With the help of DealCheck, investors can streamline this process and make informed decisions.

One specific area where this calculation becomes essential is in multifamily deals. As more people turn to short-term rentals as an investment opportunity, determining the maximum offer for such properties is vital.

DealCheck provides investors with powerful tools and algorithms that consider various factors such as rental rates, occupancy rates, operating expenses, and potential income growth. By inputting these variables into the property analysis platform, investors can quickly assess the feasibility of a deal and calculate their maximum offer.

By utilizing the DealCheck features, investors can save time and effort that would otherwise require hours or even days of manually crunching numbers, allowing them to make confident decisions based on accurate calculations rather than relying solely on intuition or guesswork.

Utilize DealCheck to Make Informed Decisions

If you want to make informed decisions analyzing a multifamily property, utilizing DealCheck is necessary. With their comprehensive tools and features, analyzing multifamily properties has always been challenging.

DealCheck offers a range of powerful tools that allow you to quickly and accurately assess the potential profitability of a property. From calculating rental income and expenses to estimating cash flow and return on investment, DealCheck provides comprehensive data and industry-standard calculations to make informed decisions when accessing a multifamily property, as you saw in this walkthrough.

By using DealCheck, you can save valuable time and effort in conducting property analysis. Their user-friendly interface makes navigating the process easy for experienced investors and newcomers. With just a few clicks, you can access detailed reports that provide insights into the financial viability of a multifamily property.

Furthermore, DealCheck’s comprehensive data and industry-standard calculations go beyond financial analysis. You can also evaluate market trends, compare different properties side by side, and even generate professional-looking reports to share with partners or lenders.

Access to accurate data is crucial in today’s competitive real estate market. DealCheck tools and features are effective at providing comprehensive data and industry-standard practices. You can confidently assess a multifamily property and make informed investment decisions aligning with your financial goals.

Conclusion

To wrap up, we sincerely believe that this comprehensive walkthrough on analyzing a multifamily property using DealCheck has provided you with valuable insights and helpful guidance. DealCheck stands out as a highly recommended tool due to its intuitive user interface, making it easy for seasoned professionals and beginners to navigate the intricacies of property analysis. Moreover, its affordability makes it an attractive choice for investors of all levels looking to make informed decisions with their real estate investments. For more information on pricing and plans offered by DealCheck, please visit our article here. Inside the article, you will find a unique promo code that can be used to save on any plan when making a purchase decision.

One of the key advantages of using DealCheck is the ability to customize each value that goes into your report. This allows you to tailor the analysis to your multifamily property and its unique characteristics. Additionally, the level of detail provided by DealCheck is extensive, giving you a comprehensive view of the property’s financials and potential returns.

Whether you are an experienced investor or just starting in multifamily deals, DealCheck can be a valuable asset in your investment toolkit. Its ease of use and affordability make it accessible to investors at all levels. So why not try it and see how it can enhance your analysis of multifamily properties?